Meeting Consumer and Revenue Demands Through Innovative Delivery Models

Consumer expectations for higher service and convenience drive their decisions about healthcare services. Innovative care companies with new business models that meet those expectations are attracting consumers away from traditional health system offerings. Disruptive competitors are one of the many pressures threatening the margins of health systems. Health system leaders should consider how to reconfigure the delivery of routine care to stay competitive and keep patients within their system.

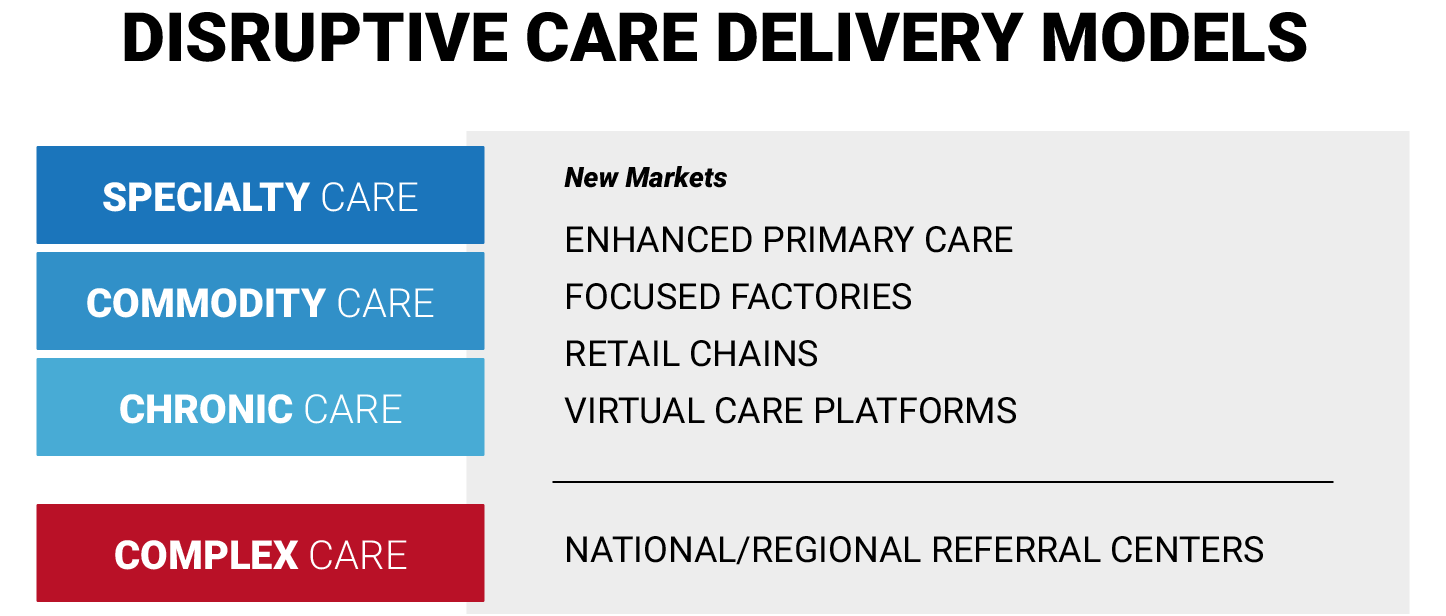

Disruptive upstarts and forward-thinking incumbents choose niches within one area of care and create a business model that delivers greater care efficiently and profitably.

As typical within a mature market like healthcare, the vast majority of needed services are actually commodities. Think of a sick visit for a sore throat, an annual physical, a colonoscopy – Consumers need this care on an episodic basis, expect a consistent outcome and convenient access for these standalone services.

Treatment for chronic conditions, such as diabetes, requires long-term care, but the in-depth understanding and standardized protocols define the likely outcomes fairly well. Because they requires frequent office visits and testing, convenience and cost gain importance for patients, although continuity of care still dominates.

Specialty care, like treatment for breast cancer, is usually episodic, but the outcome and treatment path is more uncertain. Patients want to see specialists who focus on their area of disease and can apply in-depth experience for the best results.

Health system leaders should consider how to reconfigure the delivery of routine care to stay competitive and keep patients within their system.

Patients living with multiple chronic conditions, known as comorbidities, often require specialist care, often from a team with different areas of expertise. Large hospitals and health systems often provide the most comprehensive care for these patients.

Today, traditional health systems try to offer treatment for all types of care needs. However, it’s difficult for a large system to do them all well, and provide them at a cost that still delivers positive margins. Disruptive upstarts and forward-thinking incumbents choose niches within one area of care and create a business model that delivers greater care efficiently and profitably.

Commodity care is often the first target. With a defined consumer need and outcome, a company can start from the ground up and implement a playbook that can offer superior service at a reasonable cost for the patient while still making money for the provider. Consumers are choosing walk-in clinics, such as those at Walgreens, CVS or Walmart, instead of seeing doctors at health systems or their primary care physician. Concierge primary care companies offer high-end service through in-person and virtual appointments, as well as phone and email communication.

Enhanced primary care companies are also building care delivery models to treat patients with chronic conditions. Often these new models can deliver better health outcomes at lower costs, which is especially important as the industry moves to fee-for-value reimbursement.

TAKEAWAY

To sustain market relevance, health systems must think differently and find ways to deliver the right care at the right time in the right place for their patients and community. Rather than trying to build and own every point of access, they should find partners who excel at different care access points and work together to offer a complete spectrum of services. Current business routines won’t work for delivering routine care, but through a changed mindset and strong partnerships, health systems can strengthen their brands and role in their communities and relieve some of today’s margin pressure.

Reconfiguring routine care, increasing productivity, and more effective revenue management are other value-based strategies health systems can use to become more competitive, more financially secure, and more relevant to their market. Read about them here in the article “Unrelenting Margin Pressures: Overcoming Healthcare’s Softening Revenues and Rising Expenses.”